Welcome to the Riley Township Assessor’s home page. From this page you will be able to search for Parcel information including sales, link to the County GIS system, link to the County Assessments webpage, send the assessor’s office a message and more as items are needed.

Riley Township 2025 Equalization

The 2025 Riley Township Equalization Factor is 1.0363.

If recent sales in your subdivision and neighborhood indicate that your parcel is overvalued after the application of the 2025 equalization factor, then that is a basis for an assessment complaint. Additionally, if your property or home is over-assessed compared to other similar properties or homes in your subdivision or neighborhood, this would also be a legitimate basis for an appeal. Property owners will not be able to appeal an assessment value based solely on the equalization factor.

More information on the appeal process is located at: McHenry County Assessments Website

Parcel and Sales Search

You need one of two things:

1) a Property Index Number, PIN, in the following format: 16-##-###-###. (All Riley Township PINs begin with 16)

2) or, any part of a address, home # or Street Name, (e.g. 8910 or Route 23)

***The data contained on this website is public record, made available by the Freedom of Information Act and Illinois Code. Use of this site is intended for research purposes only. Any other use is strictly forbidden.

Occasionally, this data may contain errors. Information gathered from this website cannot be used as a basis for argument until it has been verified as accurate by the Assessor’s Office.***

By clicking the I Agree button below, you acknowledge that you understand and accept the above statement

McHenry County Board Assessment Presentation 2023

These videos are from a presentation made by our McHenry County Assessments Office to explain how the property tax assessment process works, ahead of the mailing out of 2023 tax bills. This presentation was given to the County Board at its April 13, 2023 Committee of the Whole meeting.

Riley Sales Spreadsheet

Click on the following links to see all 2021-2023 sales in the Township: Excel Spreadsheet

McHenry County Appeal Forms and Links

If you would like to appeal your assessment click the link below, you can fill out, print, and submit appeals at the McHenry County website:

Appeal Forms

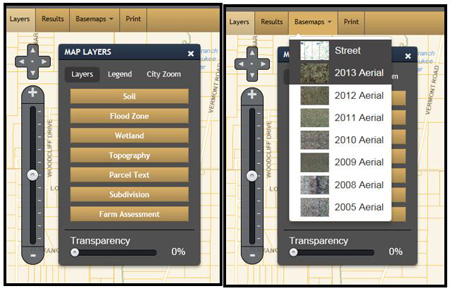

McHenry County GIS

Click on the following link to see your Parcel via the McHenry County Aerial maps: McHenry County GIS

You can use the Layers Tools to view Parcel Dimensions, Farm Land Assessments or any other helpful layers. The Basemaps can be used to see the Aerial of the PIN you are researching.

McHenry County Assessment Link

Visit the following link for much more on Assessments in the McHenry County: McHenry County Assessments Website

If you have any questions or concerns, or would like to correct any erroneous information, please contact the assessor.